Every person has a set of unique abilities that they thrive at doing; however, most of the time, we are not offered the opportunity in our work life to explore the things that make us different.

Gold is a good long-term investment, as it retains value during times of crisis (when both equities and fixed income investments tend to drop in value substantially). Gold acts as a stabilizer in a portfolio and is a good way to diversify risk. Some people prefer investing in gold, as it provides a physical tangible asset that a person can keep if they fear systematic collapse. Others choose gold as a value store and use it to hedge against inflation; due to the finite supply of gold, the price rarely drops (seen from the perspective of a long-term rolling average). In contrast, government or central bank policy decisions can have a very large impact on the supply of fiat currency.

Types of Gold Investments

Many people have gold investments and do not even realize it – these often come in the form of heirloom pieces of jewelry or antique decorative items. In these cases, the items are stores of value in both a sentimental sense and a financial one. This does not mean that one should go and buy out a jeweler as a form of sound financial investment, however. Jewelry is actually a very poor value store as most of the cost is in the labor, branding, and commercial mark-up, while the value of the precious metals or stones is often fixed.

There are much more effective ways of investing in gold:

- Gold Bullion

- Gold Funds (ETF’s)

- Gold Mining Stocks or ETF’s

- Gold Options

Gold Bullion

Gold bullion and coins are a good option for people who prefer to have the physical security that comes with holding gold investments. These do require storage and insurance, which might increase the costs to the investor. Your storage location will depend on the amount of your investment – putting two bars of gold bullion in a secure safe or safety deposit box is not a problem, whereas trying to move or store a few hundred bars is somewhat more troublesome. This is usually handled by a private institution such as a bank, and the bullions are often held in the vaults of the bank itself. This does, however, reduce the sense of security that one might feel by being able to see and hold the investment in real life.

Gold can be expensive to insure, and many home insurance companies will not cover more than $2,000 (which is currently the price of a single 1oz bar). This means that private specific insurance must be taken out to protect gold held in the home. If you are concerned about security, then a safety deposit box or a bank vault is a good alternative. A safety deposit box is a secure location, but does not provide full protection and you may need to provide extra coverage personally. A bank vault is the most secure storage method and often comes with insurance bundled in. It may seem expensive at the outset, but if you have a large amount of bullion it might end up being the most cost effective method of storage.

The Royal Mint (the official currency mint for the United Kingdom) provides storage for 1% of the market value of the gold bars. For example £100,000 of bullion would cost approximately £1000 + VAT to store for one year (as of November, 2020). By comparison, a safe deposit box would cost £550 for a medium sized box, but insurance coverage for £100,000 would be an additional £300 per annum. (prices November 2020.)

It is also important to ensure that gold is obtained through a reliable source and that the quality and purity has been certified. There have been recent scandals involving gold with unethical origins being passed as and refined with certified gold. This usually occurs when there are some intermediaries involved with dishonest intentions. To avoid this problem, one can seek out a refinery or bank that trades directly with gold mines and certifies at source or with external observers. There are also the gold ESG (Environment, Social, and Governance criteria) – risks associated with gold mining, but there are arguments that say (see article here) that with appropriate regulation and engagement, the effects of gold mining in a region can be net positive due to the positive effects of increased employment.

Gold Funds (ETF’s)

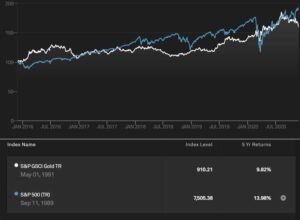

Gold funds provide easy diversification options as they can be traded like standard ETF’s within a portfolio. Usually, a gold fund is physically backed, meaning that the fund holds physical gold bullion in storage. Gold ETF’s track the gold price very closely and allow for a defensive gold position to be added to a portfolio easily. Below you can see the 5-year performance of the Gold Index vs the S&P 500.

5-Year Return of S&P 500 vs S&P GSCI Gold (S&P Global) Dates below the index names indicate the date the index was opened; the data is the 5- year data from November 2015 – Nov 2020, as indicated in the chart above.

Gold Mining Stocks or Etf’s

Gold mining stocks provide indirect exposure for investors, which comes with advantages and disadvantages.

They allow people to have a more indirect investment in gold: gold mining stocks correlate with the gold price, but are also dependent on the performance of the company itself. This may result in the stocks either under- or outperforming bullion gold. A way to diversify the risk in this sector is to instead invest in a Gold Mining ETF; the drawback of this strategy would be the potential for higher costs, since ETF’s can sometimes have high annual fees which can therefore reduce overall profitability.

Gold Options

Gold futures option trading allows derivative instrument investment in gold. By using puts and calls, an investor can create a margin or profit for themselves, but there is also a risk of substantial losses. Call options give the investor the right to buy gold (in physical or ETF form) at a predetermined price.

When Should I Invest in Gold and What Are Some Alternatives?

As with any financial market, there is no perfect timing; investing in the middle of a crisis, however, is probably too late. Due to its status as a crisis management tool, gold risk is best controlled by keeping the investment as part of a medium- to long-range strategy as part of a balanced portfolio. Gold should not be viewed in the same way as an equity investment – it is not something to be bought and sold within a few days. If you are buying gold to massively outperform the market in the long run, you will likely be disappointed. It will, however, provide downside protection in the case of a market downturn. To read more about gold risk, see this article from the AARP.

Gold is considered very good as a store of value, being unrustable and virtually perpetual. Other frequently mentioned options to store value include Bitcoin or TIPs. Bitcoin is a topic in and of itself, but gold and Bitcoin occupy two very different places in the investment sphere. Gold is a physical tangible investment that holds intrinsic value. Bitcoin, on the other hand, is a solely digital currency: although it distinguishes itself by not being pegged to fiat currency systems, it does not offer the security from systemic collapse that comes with gold – you cannot trade or barter with a digital bitcoin. Bitcoin also suffers from the same risks associated with holding cash in a bank account – it can be hacked and stolen.

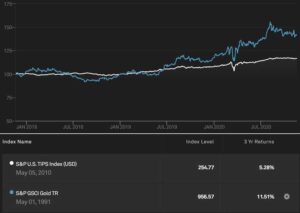

TIPs are inflation-linked treasury bonds: they provide inflation protection for investors who wish to have a defensive position against high inflation in the future. These would be a valid alternative to gold in terms of inflation protection, but gold usually outperforms TIPs during times without huge inflation spikes. TIPS also “only” measures official inflation. If inflation (expressed as asset increases in equity, real estate) is higher, gold also tends to outperform TIPs. Ruchir Sharma of the New York Times wrote about misleading inflation rates in October 2020:

“For years, central banks said there was no reason to tighten monetary policy because there was no inflation. But as many economists have argued, there appeared to be no inflation because official indexes don’t adequately capture asset prices. The United States, for example, includes only rent and a “rental equivalent” for home prices in its official indexes, which makes them increasingly misleading: Rents have lagged behind home prices for years and have slumped further during the pandemic, pushing the official inflation rate even lower.”

3 Year Return of S&P US TIPS vs S&P GSCI Gold (S&P Global)

To summarise, it is good to hold a percentage of gold as part of a well-diversified portfolio. You should consider gold as a medium- to long-term investment, and consider the costs of storage and insurance, as well as being careful to buy the gold from a reliable source from an ESG standpoint. You can choose from bullion, gold options, gold mining stocks or ETF’s, and gold funds. If you choose to diversify with gold, the percentage can vary on personal risk preference, but we usually recommend between 5 and 10%. Gold can also be a good investment option for new investors with a low risk tolerance who wish to afford themselves some inflation protection and long-term value storing for the future.

Interested in more investment advice? Check out the Cecily Group’s other blogs.