The Financial Reporting

Our financial reporting provides the basis for you and the Family Council to take strategic decisions.

Issues often Encountered

What the Financial Reporting does

Financial Reporting ultimately helps clients align their intentions better with the asset management process and other Family Office Services. It also helps asset managers to perform better at a given level of risk. In combination with a Family Council, the Financial Reporting provides an in-depth view of the financial transactions and asset management process so the asset managers can be aligned with the strategic financial intentions and needs of the family.

Performance

- Performance against a benchmark

- Performance indicators

- Relative performance against benchmarks

- Performance attribution

- …and many more

Risk

- Risk indicators

- Duration risk

- Leverage

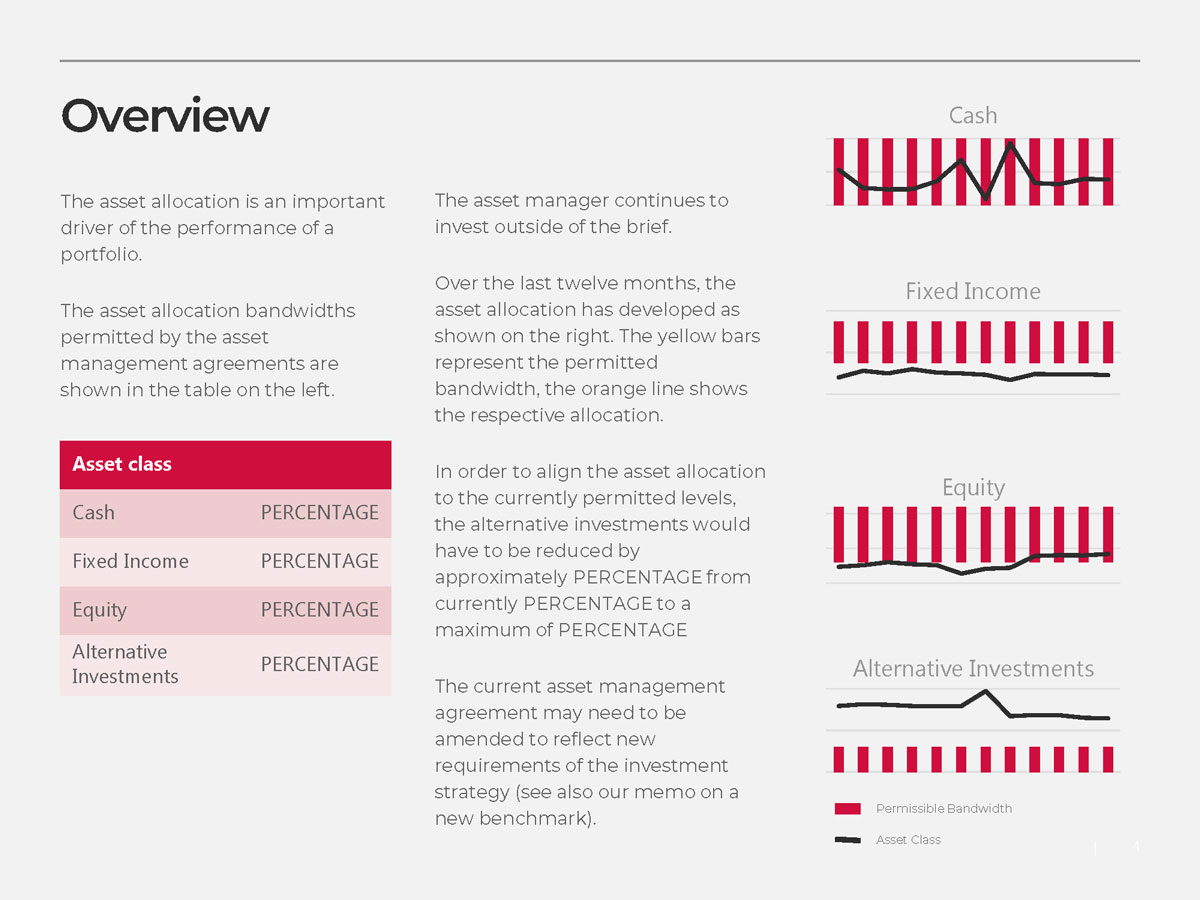

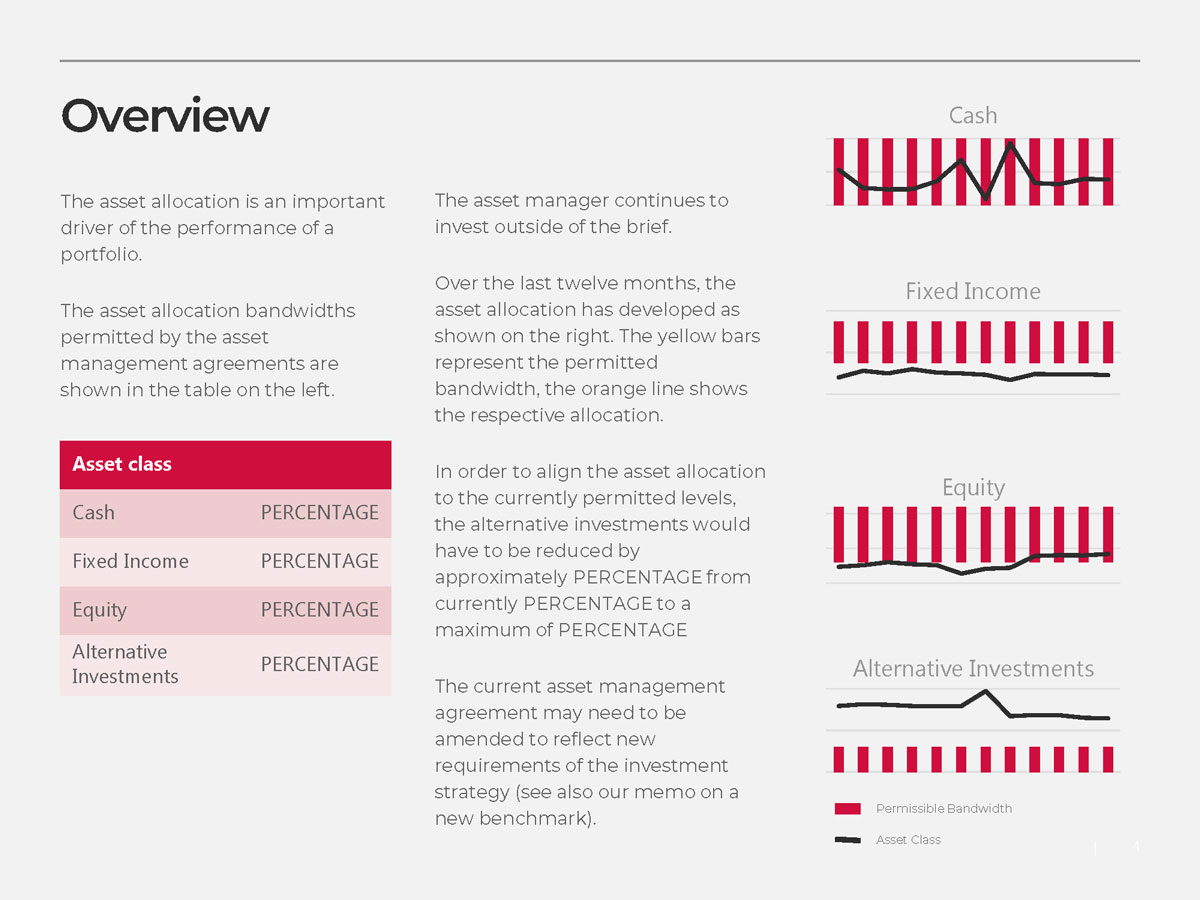

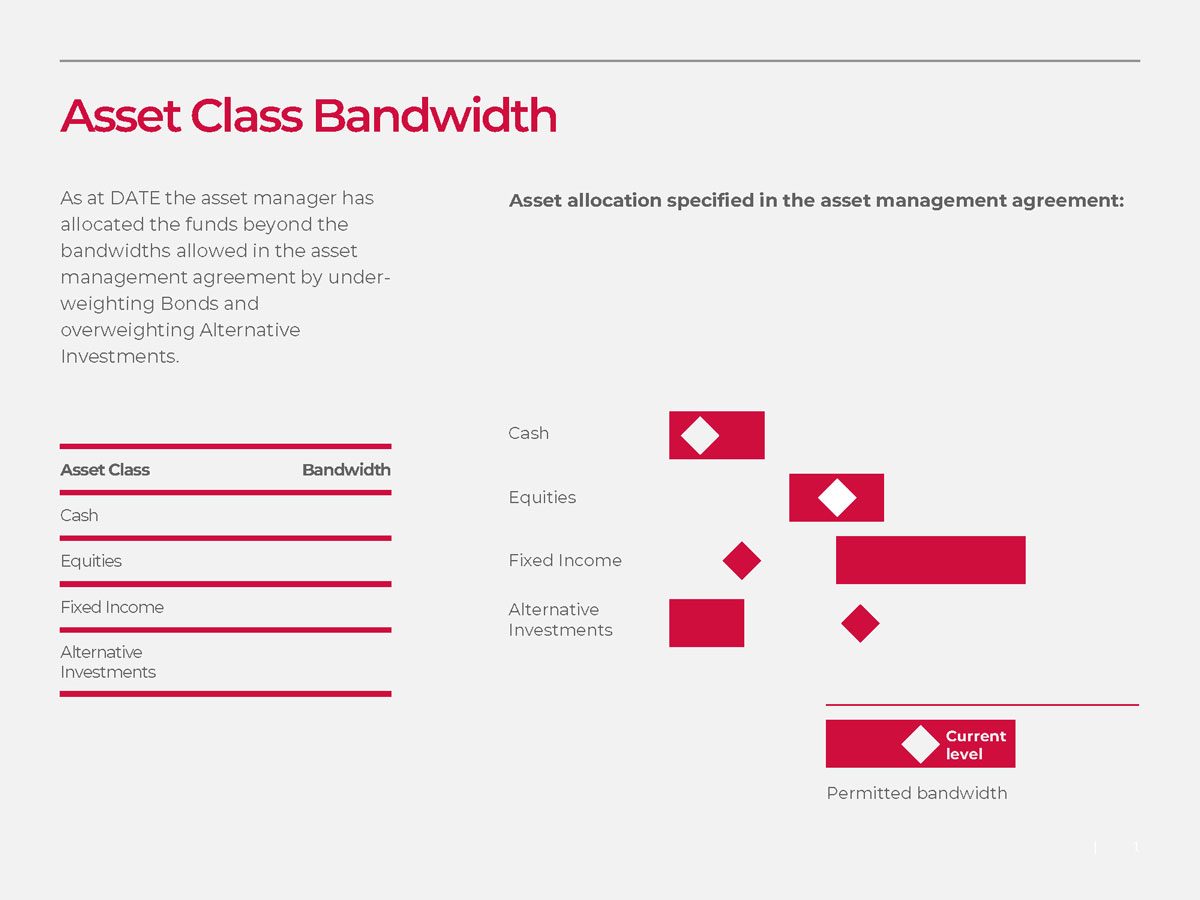

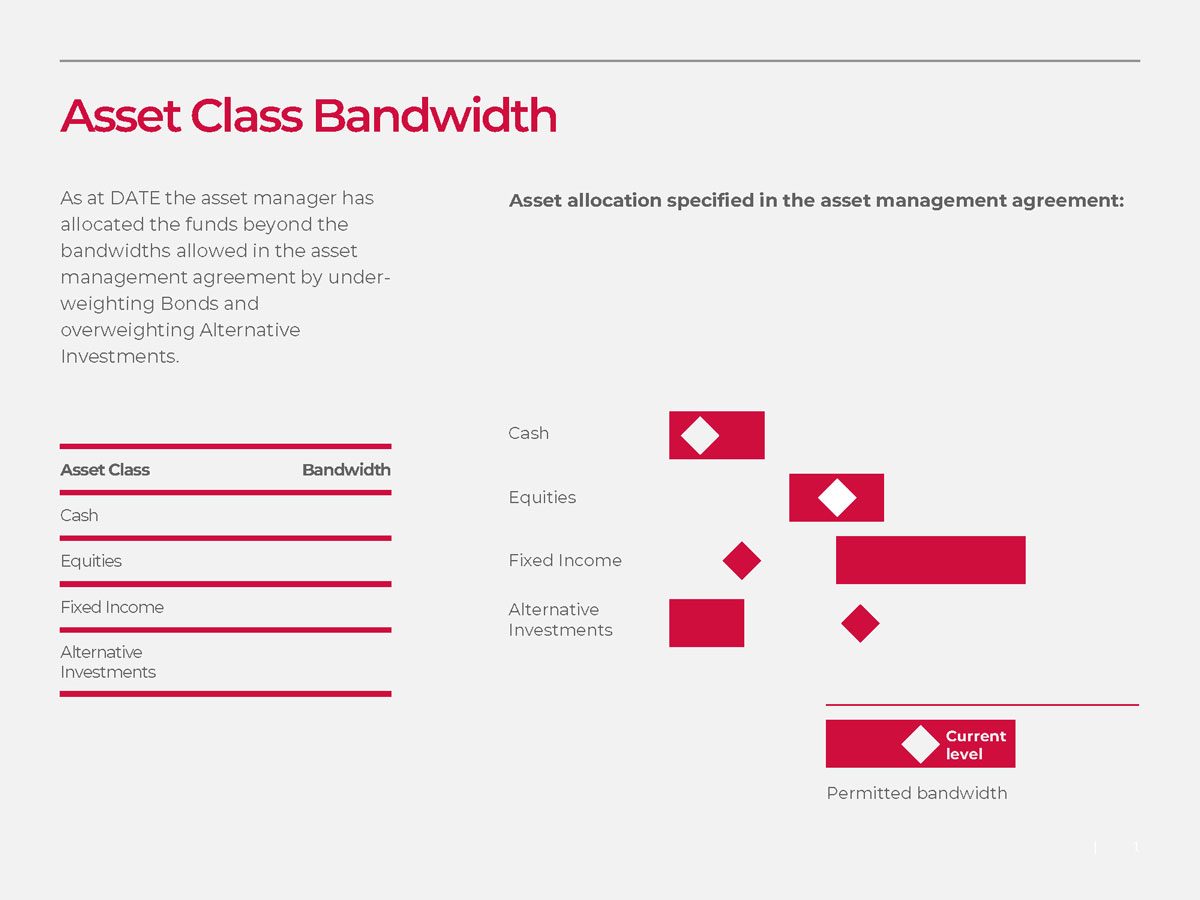

- Bandwidths

- Risk budgets

- Value at Risk

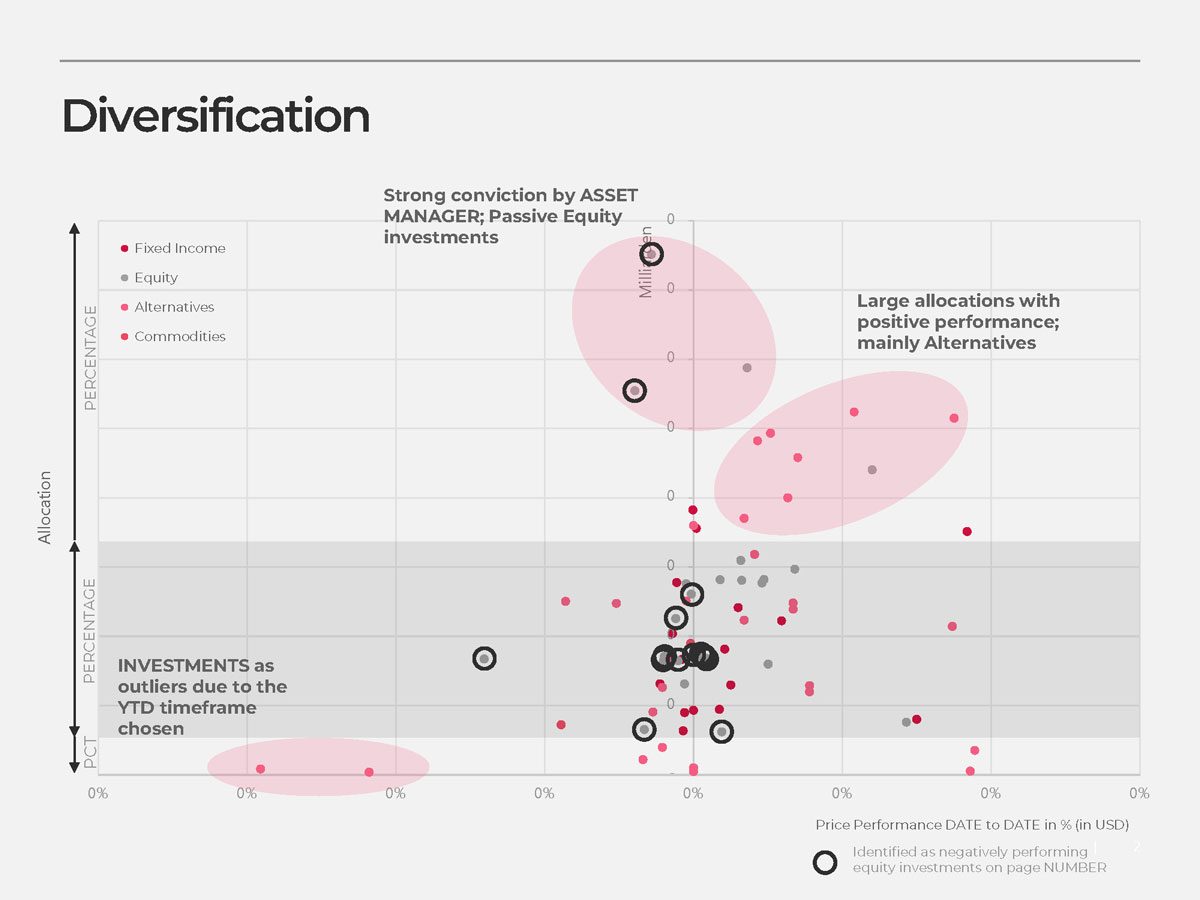

- Diversification

- …and many more

Execution

- Fees

- Activity levels

- Active vs Passive Investments

- Own products

- …and many more

The Advantages of the Financial Reporting

Clarity

- The Financial Reporting provides you with a succinct and consolidated overview of your assets and liabilities

- Activity levels of the asset managers

- The Financial Reporting allows for a more coordinated and institutional approach to setting benchmarks and devising investment policy statements

- The Financial Reporting allows for an alignment of the investment strategy with the family’s values and strategic plans

Transparency

- The performance of multiple asset managers becomes transparent, and a proper apples-to-apples comparison can be done

- The Financial Reporting provides a mechanism to ensure that all asset managers involved conduct their mandate in the best interest of the wealth owner and according to agreed-upon conditions and parameters

- The Financial Reporting provides a basis for both the wealth owner and the asset managers involved to voice ideas and concerns. Reporting is similar to a sounding board

- Financial Reporting provides the wealth owner with means to gain a greater insight into the specific investment decisions taken by the asset managers

Optimization

- The transparent comparison of asset managers allows for underperforming asset managers to be replaced by better-performing asset managers

- The consolidated reporting allows for better coordination of the asset managers’ activities and allows for each asset manager to operate in his area of expertise

- Financial Reporting allows for the allocation of risk budgets and measures how much of the risk budget is used by the asset managers. This, in turn, allows asset managers to stay close – but not above – their risk budget, and thereby increase their performance

- The Financial Reporting allows for a mechanism to set up a more efficient treasury

Independence

- You are no longer reliant on reporting provided by the asset managers. You have independent reporting available to you which provides a level playing field for all the asset managers involved

- The Financial Reporting allows the wealth owner to become more strategic in his asset allocation

- The Financial Reporting allows the wealth owner to spend less time chasing up asset managers and provides the wealth owner with a mechanism to put the generation of passive income on autopilot

Questions we often encounter

Related Blog Articles

Active vs. Passive Investing

When it comes to investing, there are two main types of management strategies active and passive investing. Both approaches help you reach your investing goals, but in different ways, and there’s a hot debate …