In the ever-evolving digital landscape, the static approaches of yesteryears to information technology (IT) infrastructure in family offices stand challenged. While Kirby Rosplock’s The Complete Family Office Handbook offers profound insights into IT considerations, including a notable discussion in Chapter 9, the rapid pace of technological advancement renders a contemporary examination crucial. This discourse endeavors to reimagine the IT infrastructure essential for modern family offices, focusing on enhancing efficiency, ensuring robust security, and meeting the unique needs that characterize these entities today.

The Core Services of Modern Family Office IT Infrastructure

1. Communication:

The digital age has revolutionized communication, demanding secure and versatile channels for both internal and external engagements of a family office. Beyond the basic need for confidentiality in email, telephony, and video conferencing, the reality of cyber threats necessitates the adoption of multifactor authentication and encryption technologies. Consider the case of a family office leveraging encrypted messaging apps for internal communication, ensuring that sensitive information remains confidential, even in transit. The deployment of virtual private networks (VPNs) and secure voice-over internet protocol (VoIP) services further exemplifies this commitment to security, showcasing how modern family offices can maintain privacy and integrity in their communications.

2. Data Storage:

The secure storage and management of digital assets, including documents, PDFs, and spreadsheets, are paramount. The concept of encryption both in transit and at rest has become a standard, yet the execution remains complex. A noteworthy example is the implementation of blockchain technology for document verification and management, ensuring the authenticity and integrity of critical documents while facilitating secure access and sharing among authorized users. This approach not only addresses the challenge of securing data on servers but also introduces a new paradigm for managing sensitive information with a higher degree of transparency and security.

3. Financial Reporting and Execution:

Asset management is the heart of family office operations, requiring sophisticated software solutions for seamless financial reporting and execution. The integration challenges with legacy data highlight the need for adaptable and forward-compatible systems. An emerging solution is the use of cloud-based platforms that offer scalable and customizable financial management tools, capable of integrating disparate data sources while ensuring compliance and security. These systems not only streamline asset management but also provide real-time analytics and insights, enabling more informed decision-making.

4. Strategic Management Tools:

The strategic management of investments, personnel, and other resources is crucial for a family office’s success. The dilemma between using off-the-shelf software as a service (SaaS) solutions and developing bespoke tools in-house often boils down to the trade-off between convenience and confidentiality. A case study of a family office developing its proprietary investment management system illustrates the benefits of tailored solutions, including enhanced security, custom functionality, and greater control over sensitive data. Such initiatives, while resource-intensive, affirm the family office’s commitment to maintaining the utmost privacy and efficiency in managing unique assets like artwork and real estate.

5. Endpoint Management:

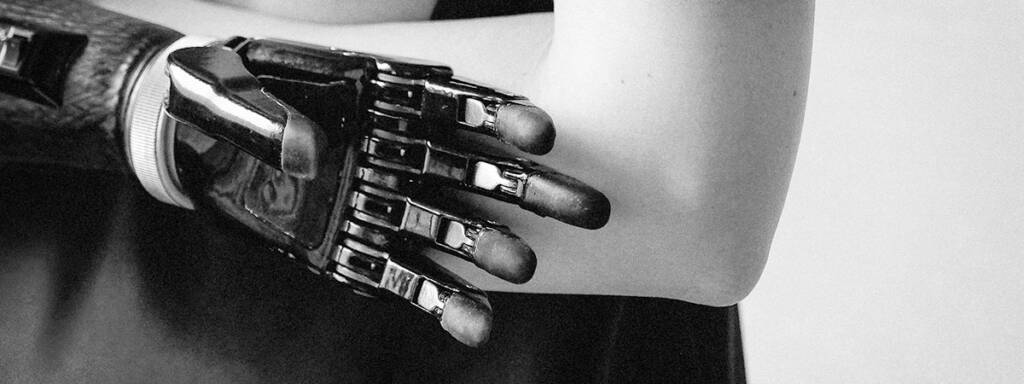

In the era of ubiquitous mobile technology, the task of endpoint management has grown both in complexity and importance, underlining the necessity to protect sensitive information while maintaining user accessibility. The challenge lies in devising security measures—such as full disk encryption and remote wiping capabilities—that do not compromise the ease of use, incorporating advanced solutions like biometric authentication to provide seamless yet secure access to authorized users.

This imperative extends beyond the professional apparatus to encompass the personal devices of family members within a family office. The intermingling of personal and professional spheres necessitates a vigilant approach to security, as personal devices become potential conduits for data breaches. Consequently, a robust security protocol covering all devices, underscored by encryption and the potential for remote intervention in cases of security threats, becomes indispensable.

Moreover, the intersection of social media with the lives of family members elevates concerns regarding privacy and anonymity, as inadvertent disclosures on these platforms can attract unwelcome scrutiny or expose the family to risk. It is, therefore, crucial for family offices to broaden their IT policies to include comprehensive guidelines and education on the prudent use of social media, aiming to instil practices that uphold the family’s confidentiality and mitigate the perils inherent to digital exposure.

6. Monitoring of Services and Zero-Trust:

The role of AI in monitoring IT infrastructure cannot be overstated. With the vast amount of data generated by modern IT systems, AI and machine learning algorithms offer unparalleled efficiency in detecting anomalies and potential security threats. A proactive monitoring strategy that leverages AI can significantly enhance the ability to respond to incidents in real time, minimizing the risk of prolonged unauthorized access. This approach underscores the importance of specialized IT staff who are equipped with the tools and knowledge to leverage AI effectively, ensuring the security and integrity of the family office’s digital ecosystem.

The modern approach to zero-trust is predicated on the principle of “never trust, always verify,” a departure from the traditional perimeter-based security model. In the context of a family office, where high-value assets and sensitive information necessitate stringent security measures, adopting a zero-trust framework is paramount.

This approach involves verifying the identity and legitimacy of all users, devices, and network connections, regardless of whether they originate inside or outside the organization’s network. It requires a comprehensive set of controls and technologies, including multifactor authentication, least privilege access, microsegmentation, and continuous monitoring of network and user activity. By assuming that threats can originate from anywhere, the zero-trust model ensures that access to resources is granted based on necessity and with the minimum rights required to perform a task, thereby significantly reducing the attack surface.

The Future of Family Office IT Infrastructure:

Emerging technologies like blockchain and artificial intelligence (AI) hold promise for revolutionizing family office IT infrastructure. Blockchain, for instance, offers a secure and transparent means of managing digital assets, contracts, and records, potentially transforming how family offices handle document verification, asset registration, and transaction logging. AI, on the other hand, can automate complex analytical tasks, enhance cybersecurity measures, and provide predictive insights into investment trends, significantly improving operational efficiency and decision-making processes.

Furthermore, the global landscape of data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and similar frameworks elsewhere, necessitates a nuanced understanding of compliance across jurisdictions. Family offices must navigate these regulations carefully, ensuring that their IT infrastructure not only meets the highest standards of security and efficiency but also complies with the increasingly stringent data protection laws worldwide.

Conclusion:

In navigating the complexities of contemporary IT infrastructure for family offices, it is clear that adopting a forward-looking strategy is not merely advantageous but imperative. This strategy encompasses the integration of state-of-the-art communication technologies, the fortification of data storage mechanisms, the utilization of sophisticated financial reporting systems, the application of strategic management tools, the enhancement of endpoint security, and the adoption of AI-enhanced service monitoring. Such an approach allows family offices to adeptly manage the intricacies of today’s digital environment.

Moreover, the expansion of endpoint management to include all devices used by family members, coupled with addressing the privacy risks associated with social media use, and embedding a zero-trust security framework, significantly bolsters the overall security posture. This comprehensive security strategy safeguards not only the operational aspects of the family office but also the privacy and interests of the families they serve. As the digital landscape evolves, so too must the strategies deployed by family offices to ensure secure, effective navigation through this terrain. Embracing these technological advancements, while steadfastly upholding security and privacy, positions family offices to adeptly meet the diverse needs of the families they represent.

Such a holistic approach heralds a new era of digital dexterity and security within the family office sector. It underscores the necessity for family offices to remain agile, continuously adapting to emerging technologies and evolving threats. This adaptability ensures the enduring resilience and confidentiality of family offices, enabling them to effectively serve their families in an increasingly interconnected and digitalized world.